Descriptive statistics of inputs and outputs.

Abstract

Performance measurement is essential for fostering continuous improvement of the production and operation management in a firm or organization. We consider a deterministic scenario based on a flexible structure of production technology and establish a multiplicative relationship between the generalized multiplicative directional distance function (GMDDF) and geometric distance function (GDF). We also introduce a stochastic multiplicative directional distance function (SMDDF). Based on a stochastic scenario, the SMDDF can be estimated by the method of convex nonparametric least squares. As an illustrative application, we investigate the productive performance of Japanese life insurance companies using a panel dataset spanning 2016 to 2020.

Keywords

- performance measurement

- stochastic multiplicative directional distance function

- data envelopment analysis

- convex nonparametric least squares

- Japanese life insurance companies

1. Introduction

The purpose of this study is to establish the relationship between the generalized multiplicative directional distance function (GMDDF, [1]) and the geometric distance function (GDF, [2]), and to develop a stochastic multiplicative directional distance function (SMDDF) for performance measurement. The GMDDF and GDF are commonly measured by data envelopment analysis (DEA, [3]), a deterministic nonparametric method applicable to multiple-input and multiple-output production technologies. Although the GMDDF and GDF have a multiplicative nature, the original GDF is measured based on a convex production possibility set, whereas the GMDDF is developed with a non-convex production possibility set. From a practical perspective, the convexity assumption may be strong if significant degrees of increasing returns exist. To address a flexible structure of production technology, previous studies in DEA also studied a non-convex production possibility set based on a geometric convexity assumption [1, 4]. The methodology of this study is based on a geometric convex production possibility set, which implicitly models a piecewise log-linear technology. Moreover, it is well known that a one-to-one correspondence relationship exists between the piecewise log-linear technology and the conventional piecewise linear technology. This makes it possible to apply the conventional DEA methods to approach the multiplicative models developed for a geometric convex production possibility set. Therefore, measuring the multiplicative type distance functions is of practical and theoretical interest.

It is also well known that DEA commonly discounts stochastic noise, suggesting that any deviations from the frontier (e.g., gauging the distance to the boundary of the production technology) can be considered a measure of pure inefficiency. By contrast, stochastic frontier analysis (SFA, [5]), a general stochastic parametric approach, accounts for stochastic noise by treating all deviations from the frontier as aggregations of both inefficiency and noise. However, compared with the flexibility of nonparametric measurements, because SFA is a parametric methodology, it relies heavily on an accurately prespecified functional form for production technology. Recently, stochastic nonparametric envelopment of data (StoNED) has been introduced in the literature on efficiency analysis. The StoNED approach relies on the method of convex nonparametric least squares (CNLS), which is a nonparametric regression technique [6]. Both SFA and StoNED are based on a convex production possibility set. This study introduces a stochastic multiplicative directional distance function (SMDDF) based on the geometric convex production possibility set and further proposes an estimation model using CNLS.

The methodology of this study consists of two basic scenarios: deterministic and stochastic. These are performed simultaneously to analyze the productive performance of Japanese life insurance companies. The application demonstrates the advantage of using a combination of GMDDF/GDF and SMDDF, enabling comprehensive understanding of the Japanese life insurance industry.

2. Preliminaries

Consider a sample of

where

requires the marginal products to be nonincreasing. However, this cannot be used to understand productive performances characterized by significant degrees of increasing returns so that the marginal products of inputs may be low with a small-scale economy and may increase sharply as the scale expands beyond a threshold (see, e.g., [9]). To allow a flexible structure of production technology, previous studies [1, 4] postulated a geometric convexity assumption, as below:

where

In this study, we proceed with the performance measurement using

where

According to definition (1), both inputs and outputs are changed simultaneously along with a given direction

P1:

P2:

P3:

where

The property P1 means that

We first consider a deterministic scenario, in which all producible input-output vectors are only affected by inefficiencies.

where

Then, the value of

where

Note that

Because of P2, we obtain

It is worthnoting that Eq. (4) is equal to the reciprocal of the geometric distance function (GDF) introduced by [2]:

which is a non-oriented efficiency measure that incorporates both input contraction and output expansion toward the projection points. Note that the original GDF is developed based on the ordinary convexity assumption. However, it is possible to reformulate the GDF on a given

Consequently,

3. A stochastic multiplicative directional distance function

In this section, we further consider a stochastic scenario in which all observations (i.e.,

where

Some properties of

P1’:

P2’:

P3’:

where

The property P1’ is evident from the definition (5). P2’ holds because the frontier containing all of the projection points

holds.

Therefore, for any positive vector

It is worth noting that the proposed

Then, it follows from Proposition 1.2 and property P2’ that

which is equivalent to

To simplify the notation, we define

Therefore,

To estimate the inefficiency for the observed DMU

Using Eq. (7), we further obtain

Let

It follows from P3 that

where

To estimate

The objective function (8) and the constraint (9) fit a linear equation for each DMU

where the constraint (14) now is a linear equation of inputs and outputs for each DMU

After solving the problem (13)–(17), it is possible to derive the expected value of the logarithm of inefficiencies (i.e.,

4. Application to Japanese life insurance companies

In this section, we investigate the productive performance of Japanese life insurance companies by considering both deterministic and stochastic scenarios. The sample consisted of 41 member companies of the Life Insurance Association of Japan (LIAJ). We considered the sample years 2011–2020. The data were drawn from the financial statements of all companies or the

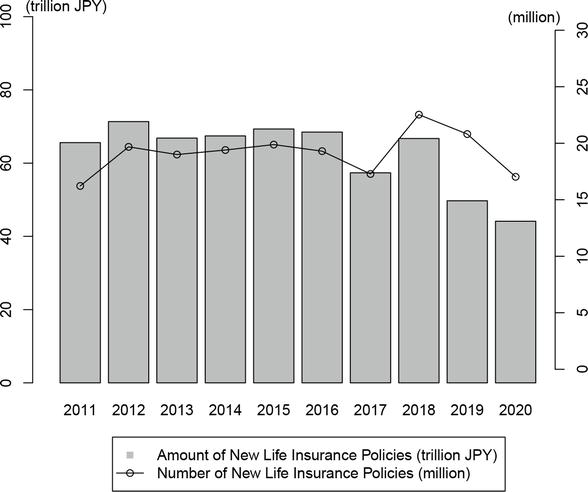

Life insurance companies play an essential role in the financial and loan markets in Japan [14]. Many of them have relied predominantly on face-to-face sales for a long period. However, since the beginning of the COVID-19 pandemic, Japanese life insurance companies were forced to temporarily suspend their face-to-face sales channels due to the nationwide declaration of a state of emergency. As shown in Figure 1, domestic sales of new policies have declined significantly since (fiscal year) 2018. According to the

Figure 1.

Trends in individual life insurance business (source: Life Insurance Association of Japan (LIAJ)).

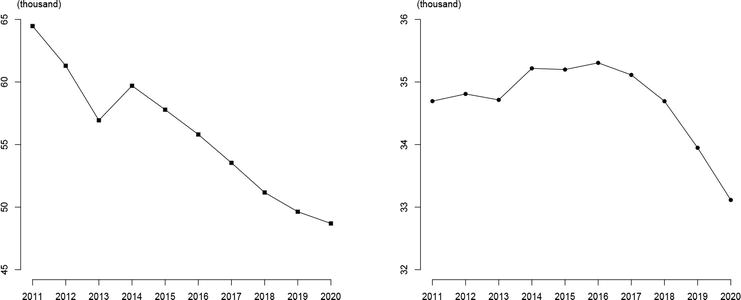

Japanese life insurance companies have changed their distribution channels over the past 10 years. It can be seen from Figure 2 that the numbers of individual and corporate agencies have been decreasing gradually in recent years. This trend should not be taken as proof that the scale of the life insurance industry has shrunk. In fact, Japanese life insurance companies have become more diversified in their sales channels due to diversifying insurance products and consumer needs and a recently increasing presence of non-traditional sales channels, such as Internet sales. Considering that life insurance companies must refrain from face-to-face sales to prevent the spread of COVID-19, a significant diversion of sales channels may lead to better performance, such as shifting from the traditional business model of face-to-face sales to online sales channels. However, sales representatives in agencies remained the primary sales channel of life insurance in 2020 [15].

Figure 2.

Distribution channels (source: Life Insurance Association of Japan (LIAJ)).

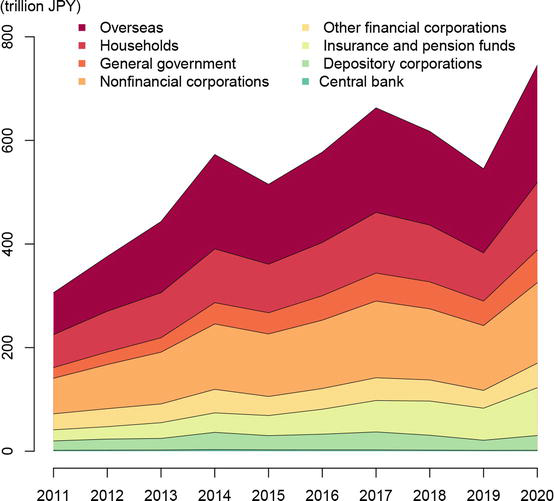

Japanese life insurance companies also play a critical role as stable institutional investors in the capital market as they hold a certain level of listed shares for a long period. Figure 3 shows the breakdown of listed shares by type of shareholder. It can be seen that the amount of listed shares held by insurance companies (insurance and pension funds) has been increasing over the past 10 years. Thus, measuring the behavior of insurance companies makes economic sense. In addition, it has been widely recognized that the current solvency margin ratio regulation introduced in 1996 does not adequately assess the valuation of liabilities and the amount of risk. This issue is expected to be solved by introducing economic value-based solvency regulations. According to the report on the economic value-based solvency framework released by the Financial Services Agency (FSA) of Japan in June 2020, the economic value-based solvency regulation will be enforced from April 2025. Since new regulations may change the business environment of Japanese life insurance companies and affect their behavior, it makes practical sense to study the past and present productive performance of Japanese life insurance companies to better prepare for the arrival of new regulations.

Figure 3.

Breakdown of listed shares by type of shareholder (source: Bank of Japan).

4.1 Inputs and outputs

To characterize the inputs and outputs of Japanese life insurance companies, we applied a value-added approach that has been commonly used in previous studies (see, e.g., [16] for a detailed discussion of the value-added approach). We considered three inputs and two outputs. The inputs were “office workers (

The descriptive statistics of inputs and outputs are summarized in Table 1.

| Years | Statisticsa | |||||

|---|---|---|---|---|---|---|

| 2020 | ||||||

| mean | 2780.76 | 3036.88 | 1118.93 | 7350.61 | 11960.23 | |

| st. dev. | 4148.45 | 4580.88 | 1371.91 | 11467.07 | 15925.40 | |

| min | 58.00 | 7.48 | 18.41 | 25.09 | 86.06 | |

| max | 21117.00 | 18952.08 | 5752.23 | 58660.91 | 67862.10 | |

| 2019 | ||||||

| mean | 2727.00 | 2799.84 | 1147.76 | 7206.73 | 11418.84 | |

| st. dev. | 3952.85 | 4297.92 | 1429.95 | 11701.79 | 16192.90 | |

| min | 31.00 | 12.68 | 9.66 | 21.10 | 61.08 | |

| max | 19425.00 | 17544.31 | 5987.46 | 61913.69 | 72114.03 | |

| 2018 | ||||||

| mean | 2708.49 | 2873.19 | 1190.10 | 7021.15 | 11835.05 | |

| st. dev. | 3950.21 | 4343.64 | 1463.74 | 12403.06 | 17165.93 | |

| min | 31.00 | 17.49 | 9.59 | 17.43 | 50.25 | |

| max | 19392.00 | 17851.78 | 6119.73 | 68688.93 | 79166.54 | |

| 2017 | ||||||

| mean | 2659.93 | 2754.62 | 1158.89 | 7059.29 | 11528.79 | |

| st. dev. | 3969.84 | 4287.69 | 1478.26 | 12414.73 | 16958.81 | |

| min | 34.00 | 9.21 | 9.88 | 13.18 | 42.84 | |

| max | 19515.00 | 18012.51 | 6005.71 | 68900.20 | 79529.49 | |

| 2016 | ||||||

| mean | 2643.37 | 2605.89 | 1152.84 | 7076.60 | 11649.00 | |

| st. dev. | 4000.73 | 4174.32 | 1486.14 | 13265.85 | 18130.89 | |

| min | 33.00 | 10.69 | 9.29 | 12.90 | 36.72 | |

| max | 19747.00 | 17412.86 | 5721.59 | 75503.23 | 86594.42 | |

Table 1.

Units of x2, x3, y1, y2: trillion yen; the unit of x1: person.

4.2 Deterministic scenarios

In previous studies, the geometric distance function (GDF) was measured

For any

Because of P3, the above problem can be equivalently reformulated as

Let

From a theoretical perspective, an exogenously given direction vector

The estimated GDF efficiencies are reported in Table 2. There were three efficient companies over the fiscal years 2016–2020: DMU05 (AEON Allianz Life Insurance Co., Ltd.), DMU18 (The Dai-ichi Frontier Life Insurance Co., Ltd.), and DMU41 (Rakuten Life Insurance Co., Ltd.). These companies can be seen as adopting best practices that were sustainable given the challenges of a changing business environment over the whole period. In addition, we also found that the Japanese life insurance industry is experiencing a downturn in performance, as the average efficiency score declined from 2016 to 2020.

| DMUsa | 2020 | 2019 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|

| DMU01 | 0.501 | 0.486 | 0.6 | 0.61 | 0.677 |

| DMU02 | 1 | 1 | 1 | 0.3 | 0.3 |

| DMU03 | 0.433 | 0.449 | 0.557 | 0.538 | 0.588 |

| DMU04 | 0.437 | 0.44 | 0.504 | 0.519 | 0.557 |

| DMU05 | 1 | 1 | 1 | 1 | 1 |

| DMU06 | 0.438 | 0.418 | 0.342 | 0.471 | 0.759 |

| DMU07 | 0.638 | 0.619 | 0.966 | 1 | 0.451 |

| DMU08 | 0.618 | 0.555 | 0.692 | 0.815 | 0.876 |

| DMU09 | 0.475 | 0.45 | 0.57 | 0.616 | 0.705 |

| DMU10 | 0.486 | 0.551 | 0.448 | 0.621 | 0.628 |

| DMU11 | 1 | 0.779 | 0.38 | 1 | 1 |

| DMU12 | 0.512 | 0.516 | 0.652 | 0.628 | 0.673 |

| DMU13 | 0.467 | 0.446 | 0.52 | 0.504 | 0.548 |

| DMU14 | 0.5 | 0.496 | 0.584 | 0.567 | 0.6 |

| DMU15 | 0.591 | 1 | 0.621 | 0.828 | 1 |

| DMU16 | 0.453 | 0.456 | 0.582 | 0.574 | 0.602 |

| DMU17 | 0.594 | 0.531 | 0.659 | 0.635 | 0.728 |

| DMU18 | 1 | 1 | 1 | 1 | 1 |

| DMU19 | 0.472 | 0.485 | 0.604 | 0.599 | 0.637 |

| DMU20 | 0.468 | 0.482 | 0.598 | 0.57 | 0.618 |

| DMU21 | 0.492 | 0.501 | 0.656 | 0.61 | 0.684 |

| DMU22 | 1 | 1 | 1 | 0.6 | 0.613 |

| DMU23 | 0.736 | 0.672 | 0.616 | 0.767 | 1 |

| DMU24 | 0.493 | 0.506 | 0.66 | 0.674 | 0.749 |

| DMU25 | 0.662 | 0.668 | 0.74 | 0.343 | 0.344 |

| DMU26 | 0.336 | 0.343 | 0.343 | 0.382 | 0.303 |

| DMU27 | 0.587 | 1 | 0.544 | 0.589 | 0.641 |

| DMU28 | 0.462 | 0.479 | 0.604 | 0.624 | 0.661 |

| DMU29 | 0.811 | 0.709 | 0.601 | 0.696 | 0.759 |

| DMU30 | 0.554 | 0.558 | 0.722 | 0.777 | 0.87 |

| DMU31 | 0.59 | 0.588 | 0.738 | 0.786 | 0.821 |

| DMU32 | 0.695 | 0.605 | 1 | 1 | 1 |

| DMU33 | 0.447 | 0.46 | 0.566 | 0.543 | 0.584 |

| DMU34 | 1 | 0.708 | 0.907 | 1 | 0.926 |

| DMU35 | 0.401 | 0.398 | 0.305 | 0.313 | 0.309 |

| DMU36 | 0.396 | 0.423 | 0.491 | 0.492 | 0.523 |

| DMU37 | 0.553 | 0.55 | 0.716 | 0.663 | 0.824 |

| DMU38 | 0.413 | 0.45 | 0.346 | 0.419 | 0.4 |

| DMU39 | 0.404 | 0.438 | 0.309 | 0.324 | 0.321 |

| DMU40 | 0.419 | 0.456 | 0.421 | 0.539 | 0.5 |

| DMU41 | 1 | 1 | 1 | 1 | 1 |

| mean | 0.598 | 0.602 | 0.638 | 0.647 | 0.678 |

| st. dev | 0.208 | 0.204 | 0.208 | 0.206 | 0.215 |

Table 2.

Results of GDF efficiencies.

The number of DMUs follows the order of the member companies of the Life Insurance Association of Japan (LIAJ), as released on November 2, 2021. We excluded HANASAKU LIFE INSURANCE Co., Ltd. from the sample because it is a new member as of April 1, 2019.

The average values of

| Year | |||||

|---|---|---|---|---|---|

| 2020 | 0.667 | 0.925 | 0.751 | 0.661 | 0.73 |

| 2019 | 0.704 | 0.867 | 0.85 | 0.65 | 0.699 |

| 2018 | 0.648 | 0.85 | 0.803 | 0.794 | 0.77 |

| 2017 | 0.651 | 0.833 | 0.815 | 0.782 | 0.78 |

| 2016 | 0.681 | 0.828 | 0.819 | 0.798 | 0.821 |

| mean | 0.67 | 0.861 | 0.808 | 0.737 | 0.76 |

Table 3.

Results of the estimated

4.3 Stochastic scenarios

Compared with the generalized multiplicative directional distance function

| Years | Statisticsa | ||||||

|---|---|---|---|---|---|---|---|

| 2020 | |||||||

| mean | −595.781 | 719.704 | 324.489 | 858.349 | 424.36 | 24.15 | |

| st. dev. | 23506.536 | 4604.907 | 2075.796 | 3837.448 | 2714.835 | 118.149 | |

| min | −56133.412 | 0.001 | 0.015 | 0 | 0.001 | 0 | |

| max | 121722.234 | 29486.327 | 13291.882 | 17161.857 | 17383.801 | 591.261 | |

| −38155.613 | 2.357 | 13291.882 | 1.082 | 0.139 | 0.14 | ||

| −56133.412 | 7.441 | 0.453 | 17161.857 | 0.193 | 0.193 | ||

| −51901.156 | 29486.327 | 0.44 | 1.423 | 0.19 | 0.202 | ||

| 121722.234 | 0.455 | 0.166 | 0.286 | 17383.801 | 591.261 | ||

| 2019 | |||||||

| mean | −191.393 | 461.661 | 792.405 | 200.862 | 232.605 | 378.179 | |

| st. dev. | 25869.435 | 2954.279 | 4945.889 | 851.021 | 1486.929 | 1850.085 | |

| min | −95754.967 | 0.002 | 0 | 0 | 0.002 | 0 | |

| max | 126825.46 | 18916.892 | 30887.494 | 3610.85 | 9521.375 | 9064.062 | |

| −95754.967 | 1.197 | 30887.494 | 0.618 | 0.125 | 0.126 | ||

| −38947.375 | 18916.892 | 0.652 | 3610.85 | 0.221 | 0.22 | ||

| 126825.46 | 0.393 | 0.187 | 0.241 | 9521.375 | 9064.062 | ||

| 2018 | |||||||

| mean | −1174.219 | 221.483 | 822.733 | 286.871 | 165.586 | 173.732 | |

| st. dev. | 20711.798 | 1416.317 | 5001.333 | 1281.837 | 1058.141 | 932.863 | |

| min | −98572.938 | 0.002 | 0 | 0 | 0.005 | 0 | |

| max | 81008.126 | 9069.146 | 30422.438 | 5732.792 | 6775.741 | 5024.123 | |

| −98572.938 | 1.303 | 30422.438 | 0.712 | 0.122 | 0.119 | ||

| −30606.077 | 9069.146 | 3.194 | 5732.792 | 0.222 | 0.226 | ||

| 81008.126 | 0.419 | 0.2 | 0.25 | 6775.741 | 5024.123 | ||

| 2017 | |||||||

| mean | 2470.9 | 117.05 | 286.855 | 338.048 | 397.955 | 277.471 | |

| st. dev. | 27075.687 | 747.405 | 1742.883 | 1547.98 | 2545.768 | 1412.526 | |

| min | −59913.335 | 0.004 | 0 | 0 | 0.004 | 0 | |

| max | 161196.848 | 4786.051 | 10601.869 | 7093.989 | 16301.242 | 7202.949 | |

| −59913.335 | 4786.051 | 10601.869 | 7093.989 | 0.262 | 0.267 | ||

| 161196.848 | 0.394 | 0.172 | 0.232 | 16301.242 | 7202.949 | ||

| 2016 | |||||||

| mean | 1543.176 | 350.93 | 112.891 | 35.068 | 299.912 | 113.54 | |

| st. dev. | 15406.705 | 1717.644 | 694.418 | 222.124 | 1641.759 | 714.694 | |

| min | −29985.44 | 0 | 0 | 0.01 | 0 | 0 | |

| max | 93237.186 | 8415.021 | 4280.92 | 1422.665 | 8992.456 | 4520.656 | |

| −29985.44 | 8415.021 | 4280.92 | 1422.665 | 0.269 | 0.279 | ||

| 93237.186 | 0.414 | 0.192 | 0.244 | 8992.456 | 4520.656 |

Table 4.

Descriptive statistics of the estimated coefficients.

† represents the DMU with extremely large or extremely small coefficients.

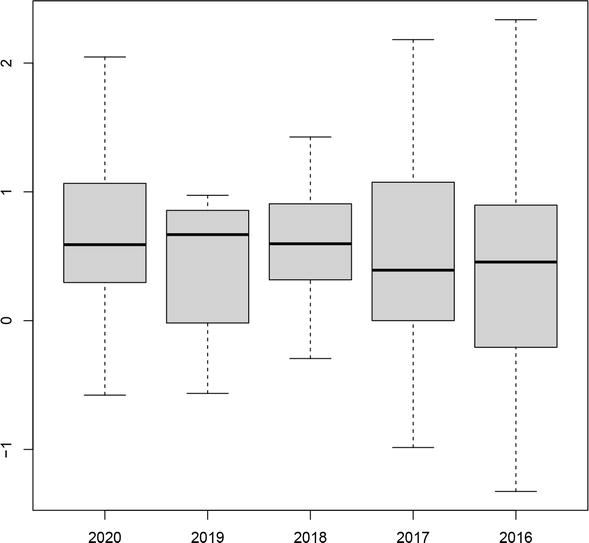

From Table 4, it is clear that the estimated coefficients exhibited significant variance over the period 2016–2020. However, few DMUs had extremely large or extremely small coefficients, and the estimated coefficients of most of the observed DMUs were in the range 0 to 1. This can be intuitively understood, for example, from the box plot of the intercepts

Figure 4.

Box plot of the intercepts

The results of the deterministic scenario show that the Japanese life insurance industry exhibited worse performance between 2016 and 2020. By contrast, the results of the stochastic scenario in Table 5 show that the estimated average inefficiency

| 2020 | 2019 | 2018 | 2017 | 2016 | |

|---|---|---|---|---|---|

| 0.144 | 0.166 | 0.15 | 0.119 | 0.11 |

Table 5.

Results of the estimated expected value of the logarithm of inefficiencies

5. Conclusions

This study considers a flexible structure of production technology that is constructed based on geometric convexity assumption. We investigated the relationship between the generalized multiplicative directional distance function (GMDDF) and geometric distance function (GDF) based on a given geometric convex production possibility set. We show that, given a deterministic scenario, the multiplication of GMDDF and GDF for the observed DMUs has the same value as the GMDDF calculated for the projection points. Based on this relationship, the GDF efficiencies can be easily measured by a DEA methodology. We also proposed a stochastic multiplicative directional distance function (SMDDF) in which all inputs and outputs are considered random variables. Given a stochastic scenario, we show that the SMDDF can be formulated as a CNLS problem. The productive performance of Japanese life insurance companies was investigated. Several companies were identified as efficient DMUs from both the results of the deterministic and stochastic scenarios. These companies can be used as projections for improving inefficiencies. Moreover, it seems that Japanese life insurance companies have a good performance in funding-related inputs since “total shareholders’ equity” and “operating expenses” were more efficient than were other inputs and outputs. By contrast, many of the Japanese life insurance companies may have suffered from poor performance in human resources. Furthermore, both the deterministic and stochastic scenarios suggest a decline in the average performance of the whole life insurance industry during 2016-2019. However, since the variations of average (in)efficiencies over the years are small, it is reasonable to conclude that the Japanese life insurance industry achieved relatively stable performance in the previous five years.

Abbreviations

| CNLS | convex nonparametric least squares |

| DEA | data envelopment analysis |

| DMU | decision-making unit |

| FSA | financial services agency |

| GDF | geometric distance function |

| GMDDF | generalized multiplicative directional distance function |

| LIAJ | Life Insurance Association of Japan |

| NLP | nonlinear programming |

| QP | quadratic programming |

| SMDDF | stochastic multiplicative directional distance function |

| StoNED | stochastic nonparametric envelopment of data |

References

- 1.

Mehdiloozad M, Sahoo BK, Roshdi I. A generalized multiplicative directional distance function for efficiency measurement in DEA. European Journal of Operational Research. 2014; 232 (3):679-688 - 2.

Portela MCAS, Thanassoulis E. Profitability of a sample of Portuguese bank branches and its decomposition into technical and allocative components. European Journal of Operational Research. 2005; 162 (3):850-866 - 3.

Charnes A, Cooper WW, Rhodes E. Measuring the efficiency of decision making units. European Journal of Operational Research. 1978; 2 (6):429-444 - 4.

Banker RD, Maindiratta A. Piecewise loglinear estimation of efficient production surfaces. Management Science. 1986; 32 (1):126-135 - 5.

Aigner D, Lovell CK, Schmidt P. Formulation and estimation of stochastic frontier production function models. Journal of Econometrics. 1977; 6 (1):21-37 - 6.

Kuosmanen T. Representation theorem for convex nonparametric least squares. The Econometrics Journal. 2008; 11 (2):308-325 - 7.

Banker RD, Charnes A, Cooper WW. Some models for estimating technical and scale inefficiencies in data envelopment analysis. Management Science. 1984; 30 (9):1078-1092 - 8.

Färe R, Grosskopf S, Lovell CK. The Measurement of efficiency of production. Vol. 6. Dordrecht: Springer Science & Business Media; 1985 - 9.

Majumdar M, Roy S. Non-convexity, discounting and infinite horizon optimization. Journal of Nonlinear and Convex Analysis. 2009; 10 :1-18 - 10.

Valadkhani A, Roshdi I, Smyth R. A multiplicative environmental DEA approach to measure efficiency changes in the world’s major polluters. Energy Economics. 2016; 54 :363-375 - 11.

Roshdi I, Hasannasab M, Margaritis D, Rouse P. Generalised weak disposability and efficiency measurement in environmental technologies. European Journal of Operational Research. 2018; 266 (3):1000-1012 - 12.

Afriat SN. Efficiency estimation of production functions. International Economic Review. 1972; 13 (3):568-598 - 13.

Kuosmanen T, Johnson A. Modeling joint production of multiple outputs in StoNED: Directional distance function approach. European Journal of Operational Research. 2017; 262 (2):792-801 - 14.

Fukuyama H. Investigating productive efficiency and productivity changes of Japanese life insurance companies. Pacific-Basin Finance Journal. 1997; 5 (4):481-509 - 15.

Nobuyasu U. Japan’s insurance market 2021. Tokyo: The Toa Reinsurance Company, Limited; 2021 - 16.

Eling M, Luhnen M. Frontier efficiency methodologies to measure performance in the insurance industry: Overview, systematization, and recent developments. The Geneva Papers on Risk and Insurance-Issues and Practice. 2010; 35 (2):217-265 - 17.

Portela MCAS, Thanassoulis E. Malmquist indexes using a geometric distance function (GDF). Application to a sample of Portuguese bank branches. Journal of Productivity Analysis. 2006; 25 (1):25-41